Life Settlement Guide

At Abacus, our goal is to become your trusted source for information about life settlements.

Get one step closer to learning the value of your policy today!

JUMP TO

Definition

Case Studies

Eligibility

Should I Sell?

Policy Valuation

The Process

Regulation

Taxation

Getting Started

What is a Life Settlement?

In terms of definition, a life settlement is the financial transaction of an existing life insurance policy to a licensed life settlements buyer for more than its cash surrender value, but less than its death benefit.

The policy owner transfers ownership and beneficiary rights to an institutional investment fund.

The insured receives a lump-sum cash payment that can often be 4 to 6 times greater than the cash surrender value in exchange for transferring ownership.

The money belongs entirely to the policy seller and can be spent at their discretion. Life settlements can also be in the form of a paid-up death benefit.

Life Settlement Terminology

In order to help you fully understand the process, we have defined some of the relevant terms that you may encounter when getting a life settlement:

Beneficiary

The person who is designated to receive a life insurance policy’s death benefit upon the insured’s death.

Cash surrender value

Also known as cash value, this is the amount the policyowner receives if they surrender the life insurance policy to the insurance company before a death benefit is paid.

Convertible term life insurance

A type of term life insurance that can be converted to permanent life insurance within a specified time frame

Death benefit

The amount of money the policy’s beneficiaries receive from the policy upon the insured’s death.

Face value

This is another name for death benefit, the amount of money the policy’s beneficiaries receive from the policy upon the insured’s death.

Illustration

Projections about the future premiums that must be paid on a life insurance policy over the insured’s lifetime, or for a term life policy, during the policy’s term. Illustrations are provided by the insurance company.

In-force

A policy is considered in-force when the premium has been paid and it is in good standing.

Lapse

A policy is considered lapsed when premium payments are missed for a period of time, including after notices have been sent to the policyowner and the period to make back payments has passed. When a policy lapses, it no longer will pay a death benefit to beneficiaries.

Term life (TL) insurance

A type of temporary life insurance that provides coverage for a pre-defined period of time (the policy term). The premiums may remain level or increase annually.

Universal life (UL) insurance

A type of permanent life insurance that includes a savings component that accrues cash value. While universal life policies generally have lower projected premiums than whole life policies, the annual cost of insurance (COI) is not fixed and goes up over time.

Whole life (WL) insurance

A type of permanent life insurance that includes a savings component that accrues cash value. Premiums for whole life policies are fixed and guaranteed. Once issued, a whole life policy is guaranteed to remain in-force for the insured’s entire life (provided premium payments are made on time), or until the policy matures.

Life Settlements Vs. Viatical Settlements

A common question people ask has to do with the main difference between life settlements and viatical settlements. A viatical settlement is a type of insurance settlement designed for chronically or terminally ill policyholders. It is fundamentally the same as other options at its core. The significant difference is that the insured person is typically suffering from an illness, and has a life expectancy of less than 2 years. Here we have it broken down:

Life Settlement

- The insured is typically a senior in their late 70s.

- The proceeds are usually around 10% to 80% of the death benefit, depending on the life expectancy.

- The funds are usually subject to taxation unless they meet IRS guidelines.

Viatical Settlement

- The insured is terminally/chronically ill.

- The proceeds usually vary from 50% to 80% of the death benefit.

- The IRS allows funds to be received as a tax-free gain if the insured meets specific criteria stated by a medical professional.

Life Settlement History

In 1911, life insurance was deemed personal property by the United States Supreme Court decision of Grigsby v. Russell, laying the early groundwork for life settlement options.

The court stated that you have the legal right to sell your life insurance policy, just like you would with your house or car.

In the late 1980s, life insurance options were primarily seen in the form of viaticals, which involves the sale of a policy by a person facing terminal illness. At that time, most individuals who sold their policies were facing either cancer or HIV/Aids.

Since then, the life settlement space has evolved into an established, well-regulated industry with licensing requirements per state.

Get One Step Closer to Learning the Value of Your Policy Today!

Use our Life Settlement Calculator for a free consultation with no obligation to sell.

Case Studies

William, 82, of Wayne, New Jersey

$4,000,000 Policy | Abacus Offer: $1,200,000

William and his family decided that a policy was no longer needed for their estate plan and considered surrendering it to the insurance company for a low payback. However, the policy beneficiary was William’s daughter, Amy, who decided to explore a better option: selling the policy to Abacus.

With William’s age and medical history, Abacus provided a payout that was double the cash surrender amount that the insurance company was offering, returning $1.2 million to his family.

Sandra, 79, of Bakersfield, California

$367,000 Policy | Abacus Offer: $110,000

Sandra came to us struggling under the weight of high monthly insurance premiums. To free up capital, she considered letting the policy go, but then learned she had other choices. Through a hybrid option that Abacus provides, we were able to help Sandra maintain the policy.

Abacus quickly paid her premiums to keep the policy current so that her beneficiaries will still receive benefits from the policy. Sandra received $110,000 to help with medical expenses and family needs.

Read more about how Abacus has helped clients receive an average of 6 times the policy’s surrender value here.

Can I Sell My Life Insurance Policy?

Yes, you can sell your life insurance policy through a life settlement—your life insurance policy is your property, which entitles you to sell if you choose to do so.

The average payout of a life insurance sale is 4-6 times the policy’s cash surrender value.

To get started with wanting to sell your life insurance policy, you will first need to see if you meet some minimum qualifying factors, such as:

- Own a policy with a $100,000 or more in death benefit – anything less than that typically does not qualify, unless there are considerable health impairments

- Life insurance policies generally qualify if you are over age 70

- A decline in health from the time when the policy was issued may help better your chances to qualify, but it is not necessary

Because each life settlement case is distinctive, these factors should only be seen as general guidelines. Each case is unique.

If the insured has a terminal illness, refer to viaticals as an option to sell your life insurance.

If you have any questions on qualification, fill out the Settlement Calculator or speak to an Abacus representative at 800-561-4148. We are happy to discuss all the options with you!

Why Do People Sell Their Life Insurance for a Life Settlement?

With health care, long-term care, and living costs on the rise, retirees often find themselves in a situation where they need more money. Here are some of the most common reasons you may consider selling your life insurance policy:

-

You Can No Longer Afford Premium Payments

Depending on the terms of your policy, changes in the insurance market or poor policy performance could drive up the price of the premiums that you pay. Or, you may have experienced an unexpected financial issue—like increased medical expenses, legal issues, assisted living costs, or tax issues. With a life settlement, you can eliminate all future premium payments.

-

Funds Are Needed To Pay For Medical Care Or Some Other Expense

Faced with economic changes or hardships, selling your policy to recoup the equity you have built over the years is a viable option to fund a significant expense. A few examples of these significant expenses could be funding assisted living, cancer treatments, or medical costs or premiums on another existing policy. Pursing a life settlement can free up some money to ensure these expenses are taken care of.

-

You Want To Re-Invest The Equity You’ve Built To Take Advantage Of A Better Opportunity

You may want to recapture the money you have paid over the years into your life insurance policy. Whether it is investing in a business, purchasing a new home, paying off a debt or tax liability, purchasing an income-generating annuity, or taking advantage of another opportunity, getting a life settlement could help achieve these goals. These are all options where the equity built in your insurance policy could better work for you and your current circumstances.

-

Your Life Circumstances Have Changed

Fidelity Investments has projected that a 65-year-old couple retiring today in good health would need $285,000 during their retirement to cover healthcare expenses alone. As we move through the various stages of life, many individuals find they simply no longer need a life insurance policy, or simply want cash now. Life changes such as divorce, retirement, the absence of an estate tax burden, or beneficiaries no longer requiring the policy benefits are potential reasons to consider selling a policy.

-

You Want Supplemental Income for Retirement

According to USAToday, the cost of a comfortable retirement varies from as little as $858,000 to as much as $1.5 million. Selling your policy can be used any way you want. For example, you may want to use those funds for traveling, buying a new house, or other ways that enhance your retirement life.

-

You Need Additional Funds To Afford Long Term Care

All long-term care costs rose in 2020, but assisted living facility costs increased the most. Instead of worrying on how to afford housing care, a settlement can provide you the financial assistance that you need to live comfortably.

Free Consultation with No Obligation to Sell!

You will be supplied with an initial offer within 24 hours of contacting us, assuming you qualify.

How Many Different Life Settlement Options Are There?

There are three life settlement options to help your financial future today: traditional, hybrid, and retained benefit. Each option is dependent on what will suit you and your family’s needs the best.

Traditional

The traditional option is to sell your entire life insurance policy for a cash amount above the policy’s surrender value.

You have no further obligations or claims to the policy, with all future premiums paid by the buyer.

- Cash Lump Sum

- No Future Payments

Retained Benefit

The retained benefit option means you would no longer pay any premiums and retain a portion of your benefit.

When the policy ends, beneficiaries will receive a guaranteed percentage, but you have no further obligations or payments to make.

- Guaranteed Percentage

- No Future Payments

Hybrid

The hybrid option is a combination of two, where you would sell a portion of your life insurance policy.

With this option, you receive a cash payment now, your beneficiary gets a guaranteed percentage of the benefit when the policy ends, and you have no further obligation to pay future premiums.

- Guaranteed Percentage

- Cash Lump Sum

- No Future Payments

How Much Will You Get for Selling Life Your Insurance Policy?

Since each case is specific, and there is not one unified answer. We treat each case personally, and with the utmost sensitivity and confidentiality. The extent of cash you may be offered for your policy can vary considerably based on the details of your case. For an instant estimate of your policy’s cash value, fill out the Abacus Life Settlement Calculator.

Here is how each qualifying factor can impact the value placed on your policy:

- Life Expectancy

Life expectancy is the approximate number of years someone can anticipate to live based on the present age, health conditions, and lifestyle.

A professional underwriting team uses the insured’s health information, current age, and information to calculate their life expectancy.

- Age Of The Insured

An older insured can expect to receive a higher payout than a younger individual in similar health with a similar policy.

That is primarily due to estimated future premium debts and life expectancy.

- Health Of The Insured

The insured’s present health condition is essential on the life expectancy calculation. The insured’s health at the point in time the policy was issued could discover significance within the pricing illustration.

For that reason, the insured’s health is an essential factor in determining your policy’s value.

- Premium Schedule

Your premium schedule was established when you initially acquired the life insurance policy and is part of your contract. It summarizes the premium requirements for the duration of the policy and any rate escalations that will occur throughout the insured’s lifetime.

More significant premium expenses reduce the amount the provider can provide to pay for your life insurance policy.

- Premium Payments

Utilizing the premium schedule and life expectancy, the provider can establish the approximate overall premium payments required throughout the insured’s life to maintain the policy in force.

The further the provider anticipates paying premiums, the fewer they can pay upfront.

- Policy Type

Though nearly any type of life insurance can qualify for a life settlement, the kind of policy can affect not only eligibility, but the size of the payout as well.

Selling a universal or whole life insurance policy

With permanent policies that can create cash value, the volume of the cash reserve can be a deciding factor in whether the policy can be eligible, and how much you might get when selling it.

A life settlement offers more money than the cash surrender value, but less than the total death benefit.

Selling a term life insurance policy

With selling term life insurance policies, the policy will frequently need to be convertible, except in the case of a viatical settlement.

If the insured has a chronic/terminal illness, a non-convertible term policy may qualify.

Other policy types, such as keyman or group policies, will require to be assessed on a case-by-case basis.

- Length of Ownership

Varying on the state in which you reside, you may be subject to a waiting period from the date you initially purchased the policy prior to selling it. This is determined by state law.

- Policy Size

As fundamental as it may seem, the greater the policy, the higher the payout—this is because the payout can be seen as a percentage of the total face value of the policy.

For instance, the payout for a $1,000,000 life insurance policy will be larger than the payout of a $100,000 policy, if all factors are identical and both settlements were estimated at 30% of face value.

With this situation, that is the distinction in $300,000 or $30,000.

What is the Cash Value of My Life Insurance Policy?

Several factors will influence the cash value of your life insurance policy, so we cannot provide a conclusive answer to that question without specific information from the insured. However, there are a few guidelines that can give you some ideas.

Often, you can expect to receive about 20%-25% of your policy benefit upfront in cash. This means that if you have a policy benefit worth $200,000, you should be able to “cash-out” for approximately $40,000-$50,000.

How To Sell Your Life Insurance Policy

As a direct buyer, Abacus has created a streamlined process to make selling your policy fast, while cutting out the middleman so that we can pay you more. Abacus Life breaks down the method of how to sell your life insurance policy into 8 simple steps:

- Deciding to Sell

Before deciding to sell your policy, the policyholder and their beneficiaries must consciously discuss and weigh out all options before pursuing this option—this means contacting your financial advisor or the Abacus team and looking into all alternatives to ensure that it is the most beneficial solution for you and your family.

There is no cost or obligation to accept an offer at any time.

- Determining Eligibility

Certain specifics determine if an individual will qualify, such as premiums, the life expectancy of the insured, and the death benefit. Abacus can let you know if you are qualified with a settlement.

By filling out our Life Settlement Calculator, Abacus can determine your eligibility and provide you with a free and instant estimate.

Once you choose to continue with selling your policy, the information disclosed will be used by an in-house medical underwriter who will calculate the insured’s life expectancy, by using medical records to determine how much the policy is worth, at no cost to the insured.

- The Offer

Abacus would then extend an offer to the insured. The proposal would be more than the price, but less than the net death benefit. The buyer must be licensed in the state in which the owner of the policy resides.

- Acceptance

If the amount offered by the licensed buyer is acceptable to the policy seller, they can choose to accept the offer and request the required documents for review.

- Contracts

Currently, the licensed buyer generates state-approved contracting documents.

These documents record the life settlement transaction and spell out the agreement between the seller and the purchaser. Both parties must sign and notarize the contracts.

- Verification

Once the contracts are executed, and all the required enclosed documents are received, the verification process begins. Often completed by a third party like a law firm, this verification agent will check that all the contracting forms have been completed correctly. They may also check that the policy is in full force and in good standing with the insurance company.

They will verify that the funds for the purchase are in an escrow account for the policy seller.

- Change of Ownership

Subsequently, we send a request for an ownership change to the insurance carrier. This step ensures that the owner is changed from the current policyholder to the buyer.

- Funds Transfer

After the insurance carrier has confirmed that the purchaser is listed as the owner, the escrow agent is instructed to release the funds to the seller. The new owner is now responsible for all premiums, and the seller has received payment for the transaction.

This is the last step of the process and concludes the transaction. The insured is then free to use the money received at their discretion.

Get One Step Closer to Learning the Value of Your Policy Today!

Use our Life Settlement Calculator for a free consultation with no obligation to sell.

How Long Does Selling Your Policy Take?

At Abacus, we aim for the life settlement process to take 30 days or less. Generally, the length of time selling a policy takes varies on a case-by-case basis.

Many parties are involved with selling a policy, such as the insured, the insurance company, the settlement provider, medical record offices, and the bank.

Depending on how long it takes for responses and communication back will determine how long it takes.

At Abacus, we will do what we can to get your life settlement processed as quickly as possible.

Life Settlement Taxation

Life settlements are taxed in 3 ways:

- Money received from a life settlement up to the tax basis is free of income tax

- Money received is greater than the tax basis, but less than the cash surrender value is taxed as ordinary income rates

- Money received that exceeds the cash value of your policy is taxed as a capital gain

The amount of taxable income is calculated by subtracting the total amount you have paid in premiums, your tax basis from the settlement amount.

Death benefit proceeds received by the beneficiaries:

Due to the death of an insured person, they are not included in gross income, and you do not have to report them. However, any interest you receive is taxable and should be reported as interest received.

For more information on how life insurance proceeds are taxed, visit the IRS.

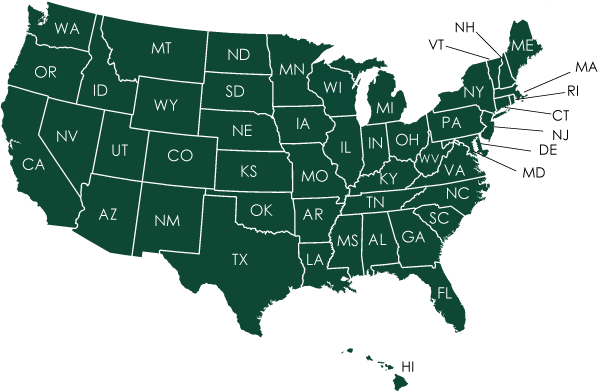

Life Settlement Regulations

Over the past decade, the life settlements market has become incredibly well regulated.

The entire market is regulated on a state-by-state basis, rather than nationally, to ensure that companies behave ethically.

Most states do require specific licensing, and practice strict oversight to ensure customer safety.

For example, according to LISA, 30 of the regulated states have a statutorily mandated 2-year waiting period before one can sell their life insurance policy, while 11 states have 5-year waiting periods. One state, Minnesota, has a 4-year waiting period. It varies state by state.

Refer to your insurance department for more insight into the specific life settlement state laws.

Here at Abacus Life, we are proud to share that we are a licensed life settlement provider in 49 states.

The following states are:

Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming

Are Life Settlements Legal?

Yes, life settlements are legal and have become a regulated industry. Laws regarding life settlements are enforced at the state level. Each state differs on specific licensing and procedures, so be sure to check with the state insurance department for more information. We want to ensure that you have all the most updated information to get started.

What Types of Life Insurance Policies Qualify to Be Sold?

Almost all types of policy types qualify to be sold through a life settlement.

While there are insurance policy types that are easier to qualify than others, such as universal life or other permanent policies, all policies will be considered.

For example, whole and term life insurance policies require more qualifications to be sold, as opposed to other policy types, however they are still eligible to qualify.

At Abacus, we will take the time to walk you through the entire process from start to finish, making sure you see all of numbers and information, from policy valuations and underwriting, to cost and returns. We want to make sure that you are well-informed and fully understand your options, so that you can make the right decision for you and your family’s future.

Can I Sell a Portion of My Life Insurance With a Life Settlement?

Yes, you can keep a portion of the death benefit, even if you sell your life insurance policy through a life settlement.

Traditionally, a life settlement is the sale of the entire policy. However, with the retained death benefit option, you can keep a portion of the death benefit, with a guaranteed percentage at the end of the policy.

The retained death benefit option also eliminates all further premium payments.

This option may benefit those who can no longer afford premiums, but still want their beneficiaries to be given a portion of the death benefit.

Create Financial Options for Your Future!

Learn about your life insurance settlement options today.

How Can I Use the Cash from Selling My Policy?

The cash from selling your policy through a life settlement has no restrictions on how the proceeds are spent. Even though it is up to your discretion how you utilize the money, here are some common ways people choose to spend their cash from a life settlement:

- Health Care/Medical Bills

As the population grows and as people live longer, the cost of healthcare is getting increasingly expensive. Increased prices for services, especially inpatient hospital care, are responsible for 50% of this increase. Life settlements have been an aid to those struggling to pay for their quickly accumulating healthcare expenses for years.

- Housing

With money from a life settlement, one can help pay off a mortgage, assist in paying for a long-term care living community, or be able to move closer to family and friends. Corresponding to a recent poll by RetirementLiving, 36.78% of seniors say it is essential to be near friends and family at this stage of their life to have their constant support.

- Supplement Your Retirement Lifestyle

With additional funds, you can use this opportunity to visit a new country or go on a road trip. A person’s “golden years” are a wonderful time to experience new things that you once did not have time for, with working and taking care of your family. A recent poll by RBC Wealth Management-U.S. states that nearly 63% of seniors say travel is an important goal, and one that they cherish.

In theory, it is your choice in how to utilize the funds for you and your family. The opportunities are endless.

What If I Change My Mind Later After Selling My Life Insurance Policy?

The rescission period, or the duration that you can change your mind after a settlement, varies by state. States typically have a period of 1 to 2 weeks where you are allowed to change your mind and return the payout in full and reclaim ownership of your policy. As soon as the rescission period expires, the life settlement is final.

Communicate with your advisor about your state’s regulations and be sure to thoroughly read the purchase agreement. If you have any questions, please reach out to us here at Abacus. We would love to talk this through with you!

Is Selling My Life Insurance Policy Safe?

Pursuing a life settlement transaction is a delicate process, and it is vital that you work with a reputable and certified company. Knowing that you are in good hands makes a tremendous difference in the process.

Abacus understands this importance, and we want to ensure that you, as the policyholder, have a smooth transition, and know that your personal information is safe with us. Once we receive your initial information to base your offer, these details stay only within Abacus.

We will also provide you with full transparency on how we generated your offer; we want to make sure that you are as comfortable and confident as possible.

Abacus is HIPAA Certified and fully licensed on a national scale, and proudly have an A+ rating from the Better Business Bureau.

How Do I Get Started on Selling my Policy?

If you are ready to begin the process of learning how to sell your policy, first try out the Abacus Life Settlement Calculator!

Abacus will provide you with an initial, free, no-obligation offer within 24 hours of contacting us, assuming you qualify to sell your policy.

Abacus Life Settlements is a fully licensed life settlement company that takes a client-first approach. We pride ourselves in putting you, the policy owner, first. However we can make this transition easier for you, please let us know. We are always happy to help!

With over $5 billion in policy fave value purchased, our offers are about 6 times the surrender value of a standard policy.

We are committed to empowering policy owners with objective insight to help them make an well-informed decision regarding their insurance policy.